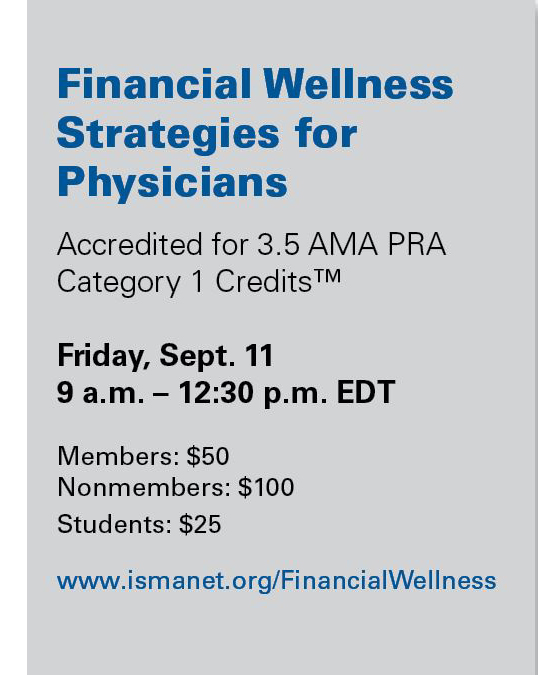

If you wish you knew more about maintaining financial health – especially during the current pandemic – you’re not alone; members have told ISMA they’d like to see more educational offerings on the subject. That’s why we’ve chosen “Financial Strategies for Physicians” as the topic for our 2020 virtual CME workshop.

The three-part program is led by Indiana experts who will cover issues important to physicians’ personal and professional financial stability.

Radio host and columnist Peter Dunn (Pete the Planner), will open the event with a session designed to help physicians identify and overcome common obstacles to financial wellness. Tom Mayer, AIF, a partner with Shepherd Financial, will explain ways to invest that can ensure financial health from medical school through retirement. And, Stacy Cook, JD, a partner with Barnes & Thornburg LLP, will explore strategies physicians can use in negotiating employment contracts to ensure their preferred outcome.

“A financial wellness program is one aspect of a broader strategy to equip physicians with resources to successfully navigate industry changes and life challenges,” said ISMA Director of Education and Professional Development Janette Helm. “It is designed to incorporate a focus on helping physicians thrive, both personally and professionally. And, now that we are working in the reality of a pandemic, the topic of financial wellness has taken on an important new dimension.”

Dunn, who some may know as an Indianapolis Business Journal columnist and the presenter of a previous ISMA webinar, will explore habits and thought patterns that can make financial wellness elusive. For instance, Dunn said, the COVID-19 pandemic is going to reveal many people’s “unwavering faith in their future income.” Often, he said, it’s the most highly intelligent and educated people – such as physicians – who are the most susceptible to overestimating their financial ability.

As part of his presentation, Dunn will do a SWOT analysis of participants’ financial standing and explain how to assess their financial health by identifying their PowerPercentageTM. “Objective financial stability is quantifiable,” he said, “but most people go with their gut feelings.”

Mayer, of Shepherd Financial, noted that it’s never too early or too late to create an investment plan. Reevaluating an investing plan periodically is important, too. “Think about all that’s changed in the last 12 months,” he said. "Maybe that means your timeline has changed or your risk tolerance has changed.”

During the workshop, he’ll talk about ways to invest and ensure financial stability at all stages of medical education and practice. He’ll also explain how a financial adviser can help physicians form creative strategies to maintain their lifestyle while reducing taxable income and saving for a comfortable retirement.

Stacy Cook, of Barnes & Thornburg, will share strategies physicians can use to successfully negotiate the employment contract terms that are most important to them. A key strategy is to be prepared: “Work with an attorney and a physician mentor who is independent from the employer,” she said.

She said a common mistake physicians make in negotiations is not asking for changes to a contract because they assume the employer won’t make changes.

Do potential employers view physicians who want to negotiate in a negative light? “No,” Cook said. “Professional negotiation demonstrates to the employer that the physician knows what he or she wants in order to be satisfied and successful in the relationship.”