By Chelsea R. Kurth, JD

ISMA General Counsel

| |

|

Don’t forget to take advantage of your 5% premium credit

on ProAssurance malpractice coverage

ProAssurance is ISMA’s preferred medical professional liability insurer, and ISMA members are eligible to receive a 5% premium credit on professional liability coverage from ProAssurance. For more information and to access this important benefit of ISMA membership, visit our website.

|

|

|

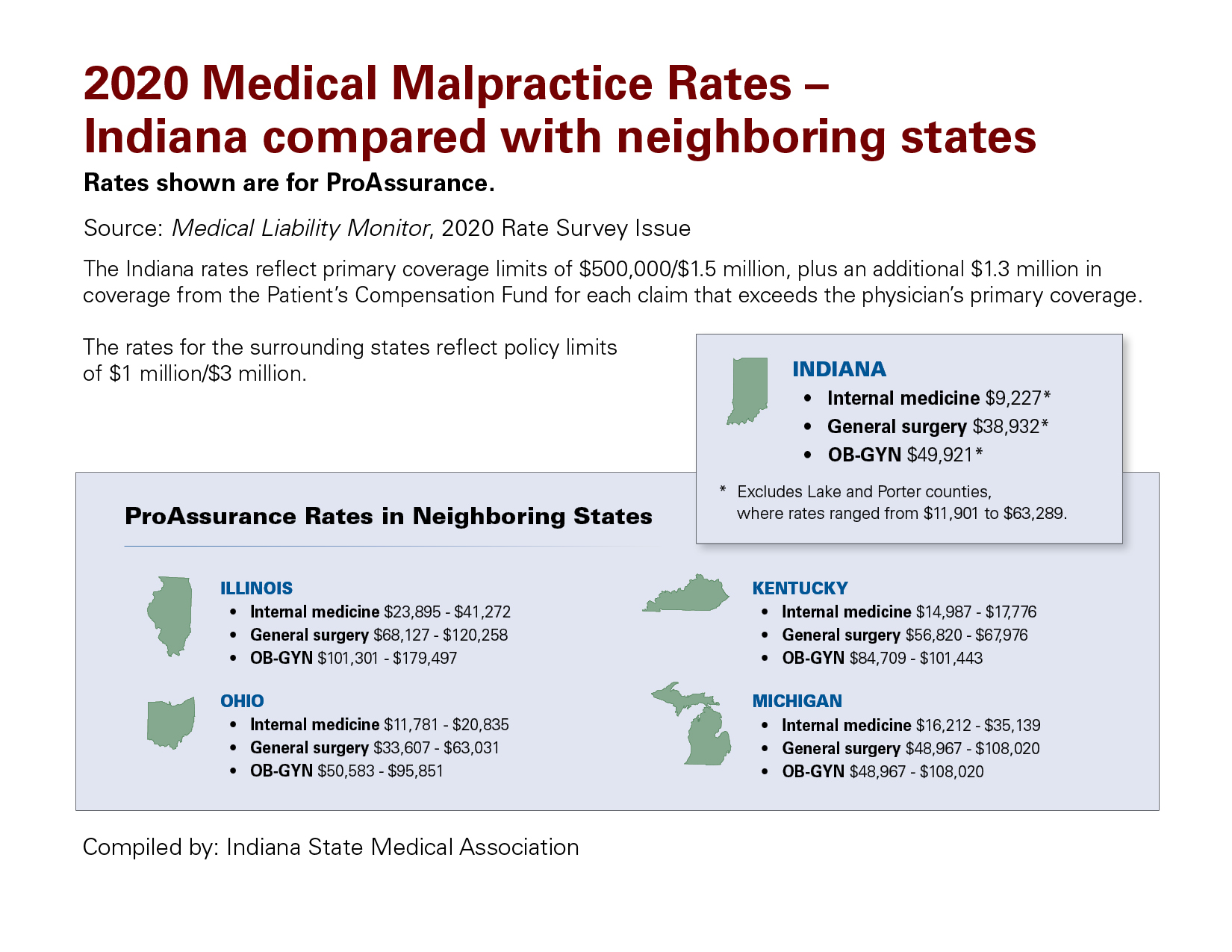

Each year, the Medical Liability Monitor (MLM) publishes the commercial rates for major liability insurers in all 50 states for internal medicine, general surgery and OB-GYN specialties as part of its annual rate survey issue, which is published every October. The issue provides a reference point for comparison of rates in other states but does not reflect credits or other factors that might impact final rates. The issue also provides information regarding surcharge rates for states with patient compensation funds (PCFs), including Indiana.

According to the MLM, the overall rate change nationwide from 2019 to 2020 was approximately +1.0%. The MLM also reported that rates in states without PCFs increased by 0.8%, while rates in states with PCFs saw a 2.1% increase (this increase accounts for adjustments to surcharges in states with PCFs, and the increase was only 1.2% if those changes are excluded).

Compared with its neighboring states of Illinois, Kentucky, Michigan and Ohio, the ProAssurance rates in Indiana remain highly competitive and – in most instances – are much lower. Also, despite the nationwide increase in rates for states with PCFs, the ProAssurance rates in Indiana remained the same as those reported for 2019. The ProAssurance rates in Illinois, Michigan and Ohio also remained consistent with those reported last year, but the ProAssurance rates in Kentucky for the reported specialties increased by approximately 19.5%.