A new report by the American Medical Association (AMA) details how Indiana physicians contribute to their communities in a key area besides patient care: They add $26.4 billion a year to Indiana’s economy.

The AMA study, “The National Economic Impact of Physicians,” looked at the 13,306 osteopathic and allopathic physicians in Indiana who were primarily engaged in the practice of medicine in 2015. It quantified their direct impact on jobs, wages and benefits, tax revenues and overall economic output, as well as their indirect impact on industries that are supported by physicians.

“We know Indiana physicians benefit the diverse rural and urban communities they serve by caring for patients,” said ISMA President John P. McGoff, MD. “This research shows how their dedication also helps create economic stability.”

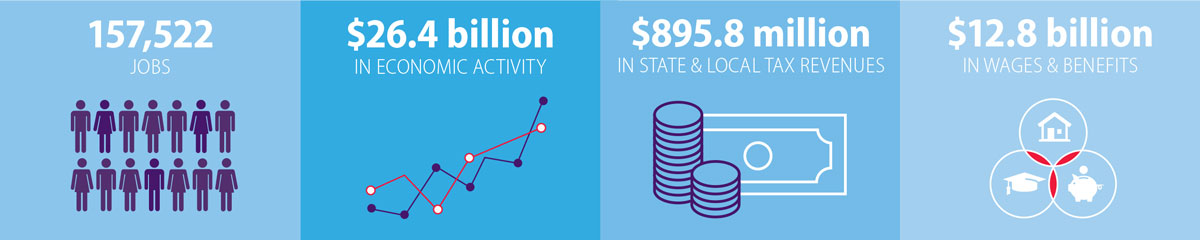

Indiana physicians’ overall economic impact in 2015 was as follows:

Total output: $26.4 billion in direct and indirect economic output. On average, each physician supported $1,982,113 in output.

Jobs: 157,522 jobs (including their own) directly and indirectly. On average, each physician supported 11.84 jobs.

Wages and benefits: $12,836 million in direct and indirect wages and benefits for all supported jobs. On average, each physician supported $964,708 in total wages and benefits.

Tax revenues: $895.8 million in local and state tax revenues. On average, each physician supported $67,321 in local and state tax revenues.

The study also found that each dollar in direct output generated by physician services in Indiana supports $1.91 in other economic activity. Physician-driven economic activity in Indiana is greater than for legal service, home health care, higher education and nursing home and residential care.

“The AMA’s economic impact study illustrates that physicians are strong economic drivers that are woven into their local communities by the commerce and jobs they create,” said AMA President David O. Barbe, MD, MHA. “These quality jobs generate taxes to support schools, housing, transportation and other public services in local communities.”

The study includes metrics for all 50 states and the District of Columbia. To view the full report and an interactive map, visit

www.PhysiciansEconomicImpact.org.